Big Data Financial Services

Working together to digitalize the world of finance

The digital transformation, constantly evolving regulatory and statutory requirements, new technologies and individual customer demands all present a steady stream of challenges for financial institutions. New and complex requirements for financial service providers and increasingly stringent regulations mean that the structural and operative effort involved in meeting them is growing and the scale of dependencies and complexities is increasing.

Without any countermeasures, this can quickly lead to inconsistencies and a lack of transparency, which in turn cause inefficiencies and a drop in quality. Some of the challenges we see in the area of digitalization and banking topics are listed below.

The challenges

Digitalization

-

Updating IT infrastructures

-

Cloud & cloud compliance

-

Data quality management

-

Breaking down data silos

-

Process support through suitable platforms, AI and tools

-

Supporting internal control systems (ICS) by automating controls

Banking topics and regulations

-

Environmental, social and governance (ESG)

-

Integrated risk management, and governance, risk management and compliance (GRC)

-

EBA guidelines, MaRisk and BAIT

-

Growing requirements concerning external audits (e.g. through the Federal Financial Supervisory Authority (BaFin) and/or year-end audits)

On top of these framework conditions, financial institutions must also ensure that they remain attractive to employees and customers in the short, medium and long term.

How to find solutions? Financial institutions must identify the challenges involved in digitalization, regulatory matters and banking topics before it is too late and implement well-structured solutions using holistic approaches.

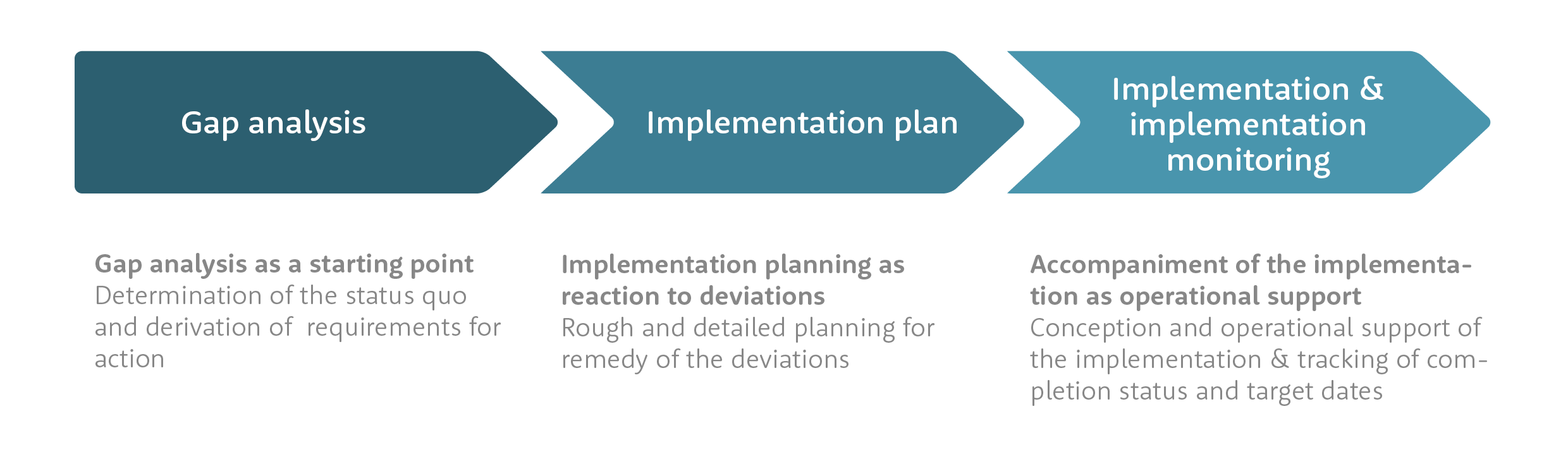

Our approach

Our approach to finding solutions:

Our approach to finding solutions:

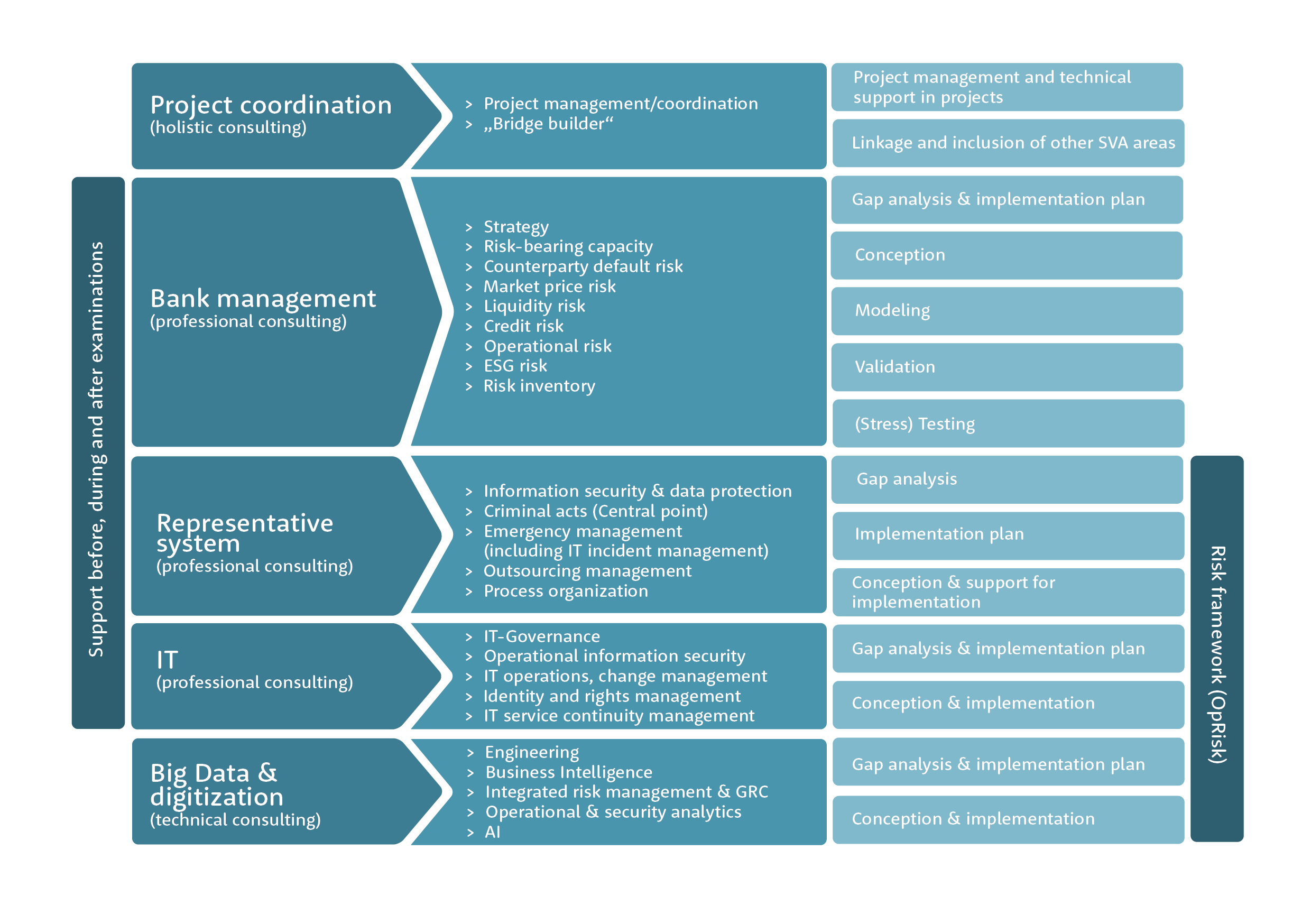

As one of Germany’s leading system integrators, SVA steps up to the mark by marrying technical and specialist challenges. With the Competence Center Financial Services, we support you in overcoming specialist challenges with sector-specific solutions and cutting-edge technology. We view challenges as an opportunity for continuous improvement.

Implementing regulatory requirements, such as EBA guidelines, MaRisk and BAIT

Regulatory specifications cover the entire banking industry. The ever-growing number of regulatory requirements means that banks and their service providers need special knowledge and expertise. At the forefront, we wish to highlight:

-

The Minimum Requirements for Risk Management (Mindestanforderungen an das Risikomanagement; MaRisk), which forms a qualitative framework for identifying, assessing and managing all significant risks at an institution

-

Supervisory Requirements for IT in Financial Institutions (Bankaufsichtliche Anforderungen an die IT; BAIT), which places the awareness of IT risks at the forefront

We help you meet regulatory requirements while also ensuring that your operative and strategic business operations remain the focus.

Support before, during and after audits, e.g., Federal Financial Supervisory Authority (BaFin) audits, year-end audits or internal audits

Good preparation for upcoming audits is usually the key to avoiding uncertainty and surprises, as well as getting through the audit with the best possible outcome and no critical findings.

We provide comprehensive expertise in conducting and consulting on audits and in processing findings to support you before, during and after year-end audits and special audits.

Integrated risk management, and GRC

Governance, risk management and compliance (GRC) means considering these three disciplines in a holistic (integrated) way in organizations. In doing so, GRC is designed to prevent silos and inefficiency in companies through communication and the exchange of information, so that company goals are achieved reliably. Because the focus lies on considering these different principles in a holistic way, high value is also placed on IT. We help you develop an integrated risk management approach.

Cloud & cloud compliance

Cloud solutions play a key role in the competitive and innovative capabilities of financial service providers. Implementing cloud solutions brings advantages such as flexibility, efficiency and strategic benefits. However, one of the biggest challenges they present is compliance with the requirements of data protection and information security law. To safeguard long-term success while also complying with statutory and regulatory requirements, we support you on your journey into the cloud and in topics concerning compliance in the cloud.

Automating process steps and controls

Customer and market demands on the one hand, and digitalization on the other, are forcing financial institutions to make a multitude of processes even more effective and efficient. Automating and standardizing processes opens up possibilities for maximizing customer satisfaction and frees up employee capacity – while automating process control actions increases quality with less effort. We help you to analyze and implement automation capabilities within your processes and process control actions.

Environmental, social and governance

The subject of environmental, social and governance (ESG) refers to a sweeping development in our society and economy whereby banks are assigned a special role as intermediaries for achieving various social and economic goals. Financial institutions enjoy particular opportunities in financing the green transition, such as in renewable energies. On the other hand, the risks of the green transition also present challenges, which are then amplified by the digitalization process and the ever-increasing body of regulatory requirements. We offer support and advice for integrating ESG into your business.

Any Questions?

If you would like to know more about this subject, I am happy to assist you.

Contact us